Marketplace

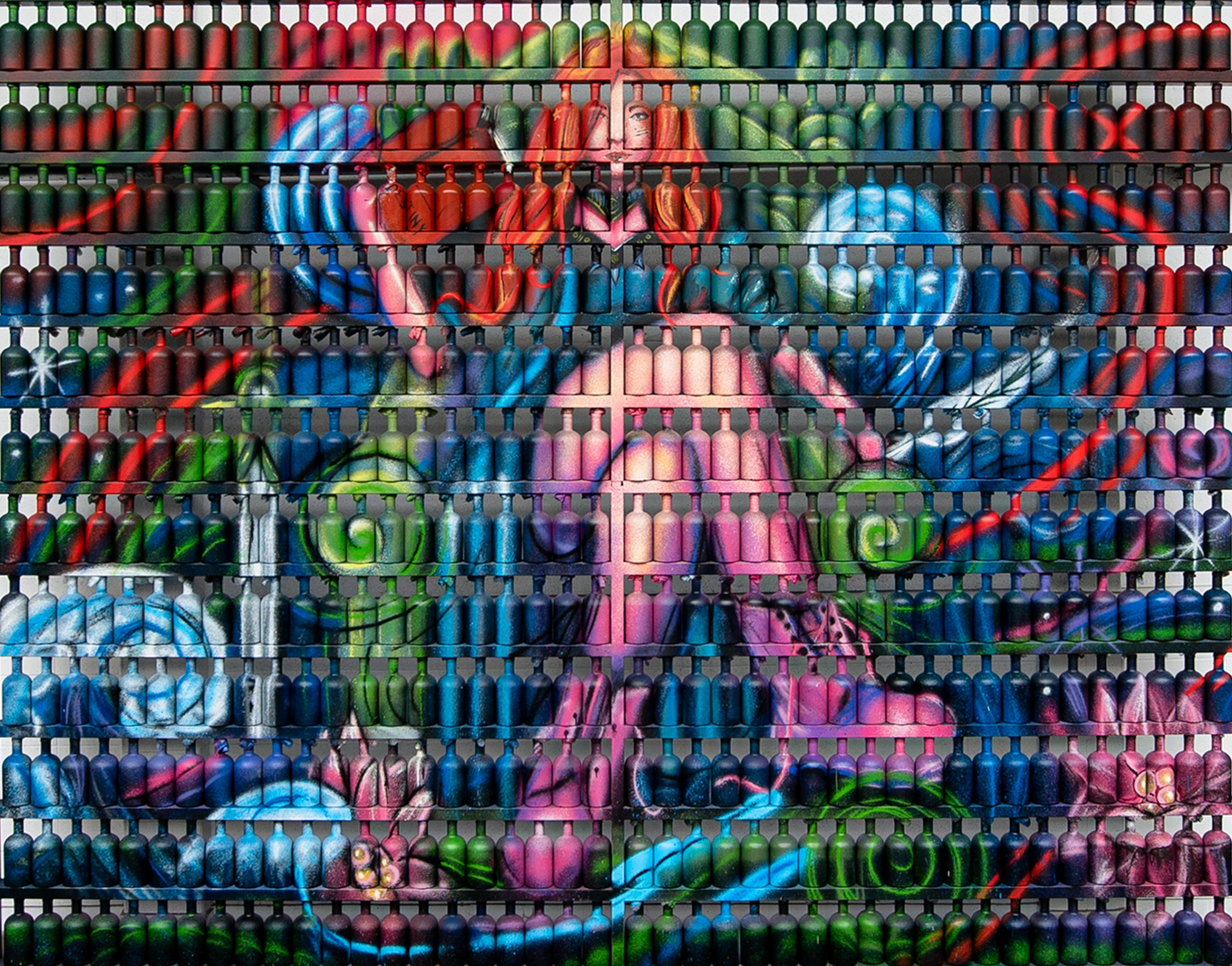

The Grace

Grace O'Malley

To the Collection

The Private Cask Collection

Preserving the provenance of privately owned casks

To the Collection

RAREcask First Edition

House of RARE

To the Collection

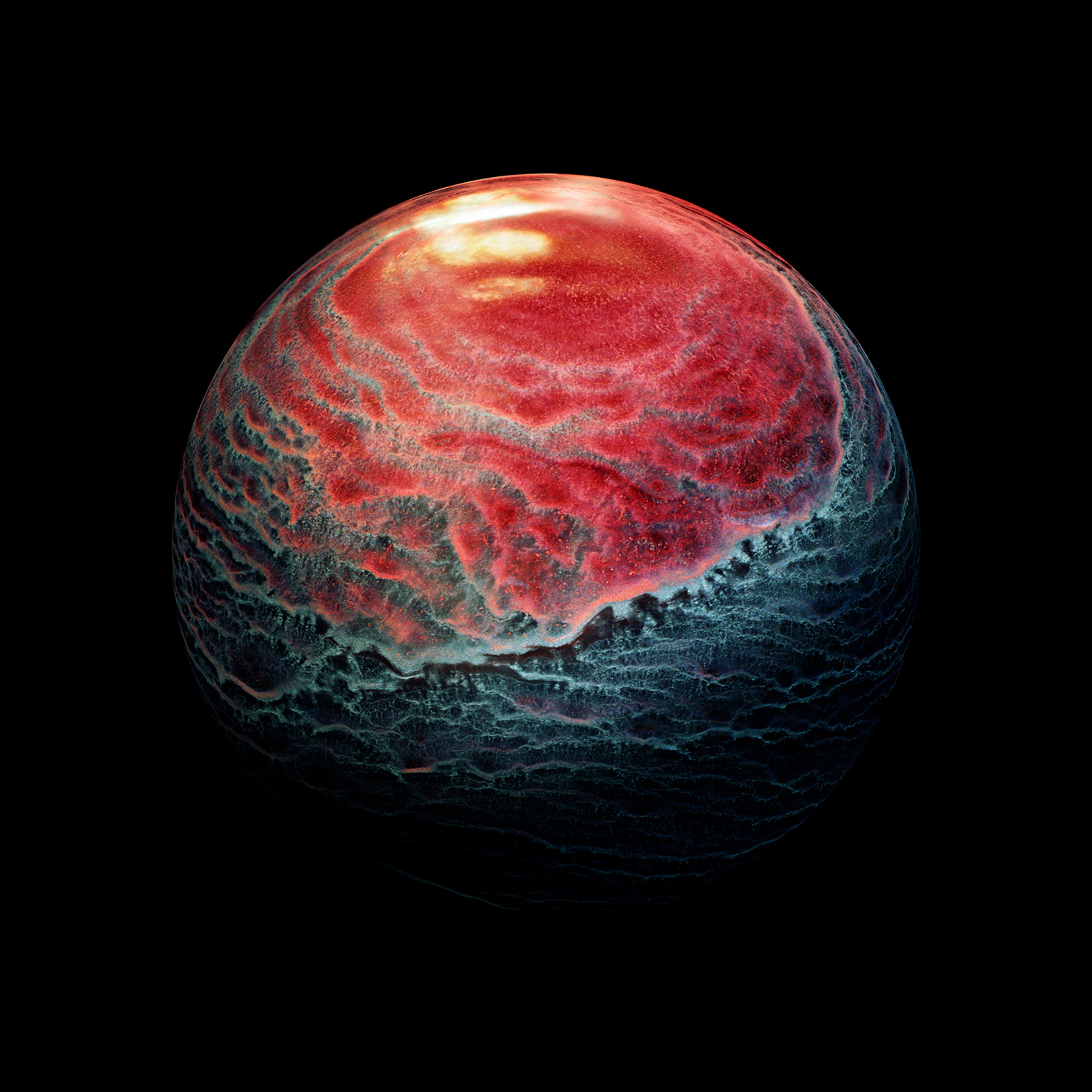

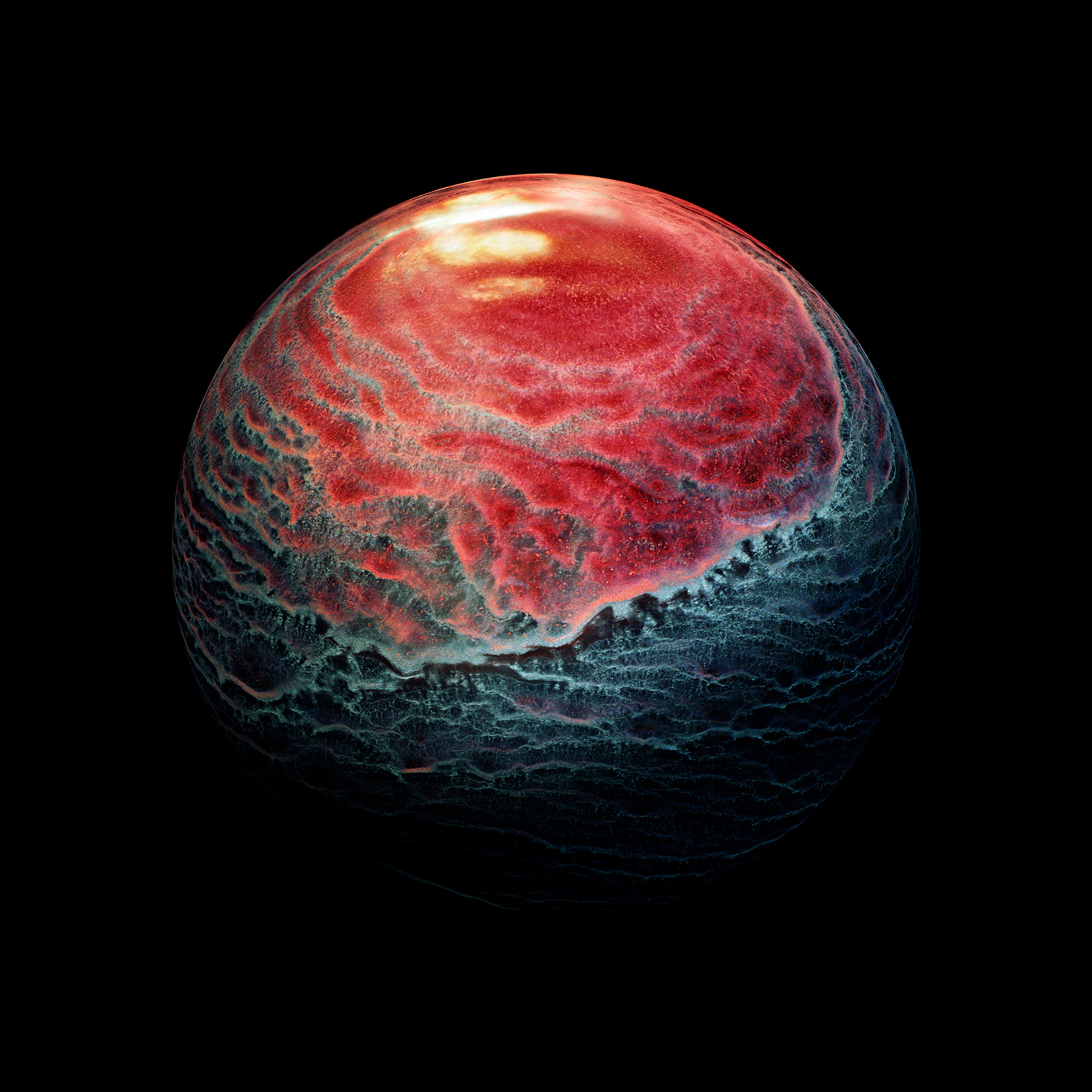

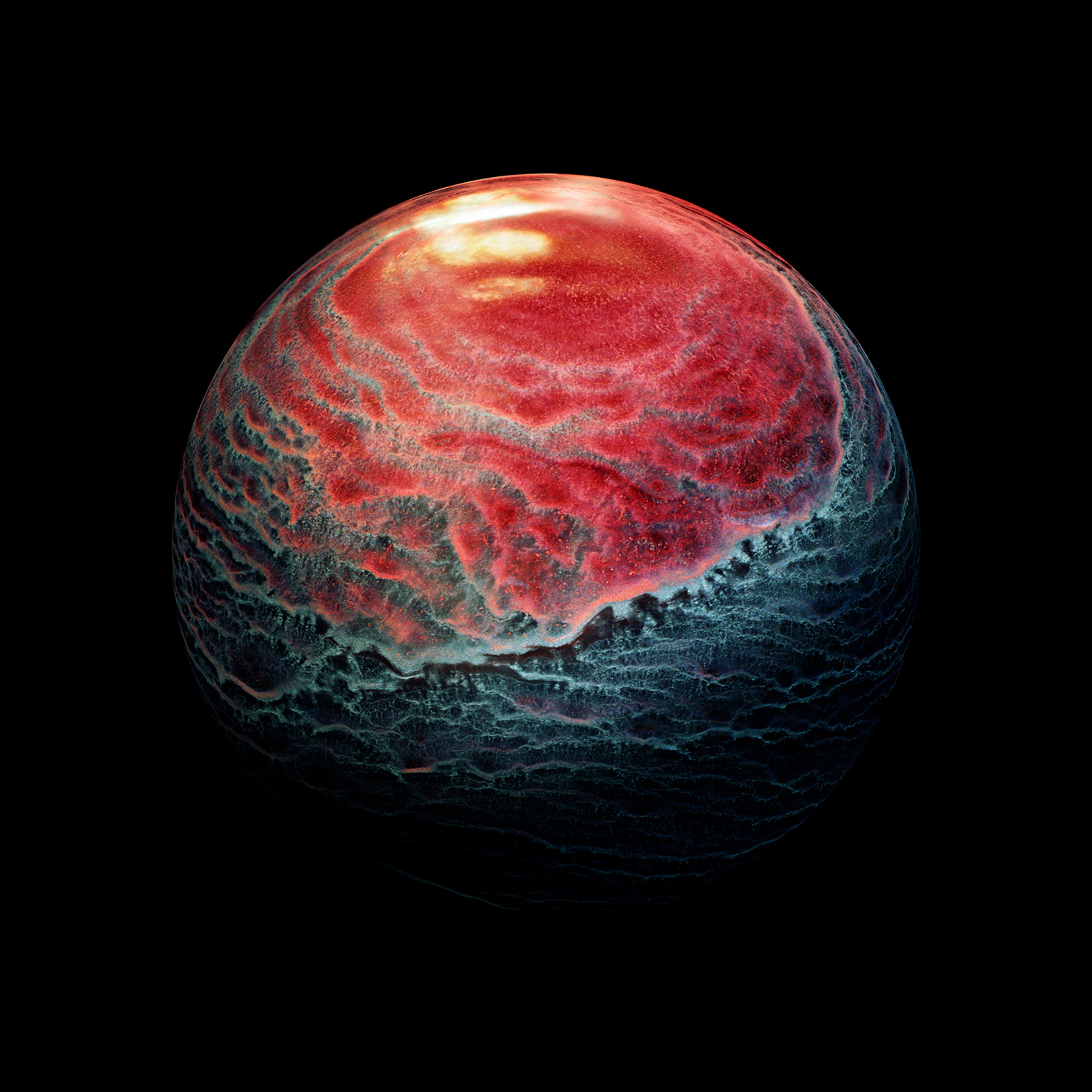

The Vanishing Spirits

A collection of Single Malt Whisky Casks paired with a photograph of the distillate from the whisky in the cask by Ernie Button

To the Collection